Amica home insurance cost – Choosing the right home insurance is crucial for protecting your most valuable asset. Amica Mutual Insurance, known for its strong financial stability and customer service, offers a range of home insurance options. However, understanding the cost of Amica home insurance can be complex. This detailed guide will break down the factors influencing your premium, provide tips for saving money, and answer frequently asked questions.

Factors Affecting Amica Home Insurance Costs

Several factors contribute to the final cost of your Amica home insurance policy. It’s not a one-size-fits-all situation; your premium will be personalized based on your specific circumstances. Let’s delve into the key elements:

Location

Your home’s location significantly impacts your insurance cost. Areas prone to natural disasters like hurricanes, earthquakes, wildfires, or floods will generally have higher premiums due to increased risk. Amica, like other insurers, assesses the risk associated with your specific address, considering factors such as proximity to fire hydrants, crime rates, and the overall condition of your neighborhood.

Home Value and Coverage Amount

The value of your home directly correlates with your insurance premium. A higher-valued home requires more coverage, leading to a higher premium. The amount of coverage you choose also plays a role. While underinsuring your home can leave you vulnerable in case of a significant loss, overinsuring can be unnecessarily expensive. It’s essential to find the right balance between adequate protection and affordable premiums.

Accurate home appraisals are vital for determining the appropriate coverage amount.

Home Features and Construction

The features of your home and its construction materials impact the risk assessment. Homes with updated safety features, such as fire alarms, security systems, and impact-resistant roofing, may qualify for discounts. The age of your home, its building materials (brick, wood, etc.), and its overall condition all play a role in determining your premium. Proper maintenance and upgrades can potentially lower your insurance costs.

Coverage Options

Amica offers various coverage options, each impacting the overall cost. Choosing a higher deductible, for example, will generally lower your premium. However, this means you’ll pay more out-of-pocket in the event of a claim. Consider your financial situation and risk tolerance when selecting your deductible. Additional coverages, such as flood insurance (often purchased separately) or earthquake insurance, will increase your premium but provide broader protection.

Claims History

Your past claims history significantly influences your insurance rates. Filing multiple claims in the past can lead to higher premiums, as it suggests a higher risk profile. Maintaining a clean claims history is crucial for keeping your insurance costs manageable. Driving history can also be a factor in some cases.

Discounts

Amica offers various discounts to help lower your premiums. These may include:

- Bundling discounts: Combining your home and auto insurance with Amica can often result in significant savings.

- Home security discounts: Installing security systems, such as alarms and monitoring, may qualify you for a discount.

- Loyalty discounts: Long-term policyholders may be eligible for discounts.

- Payment discounts: Paying your premium annually instead of monthly can sometimes lead to lower costs.

Getting an Amica Home Insurance Quote

To get an accurate quote for Amica home insurance, you’ll need to provide them with detailed information about your home and your coverage needs. This typically includes:

Source: insuranceblogbychris.com

- Your address

- The year your home was built

- The square footage of your home

- The type of construction materials used

- The value of your home and its contents

- Your desired coverage limits and deductibles

You can obtain a quote online through Amica’s website, by contacting an Amica agent directly, or through an independent insurance broker.

Tips for Saving Money on Amica Home Insurance

While you can’t control all factors affecting your premium, you can take steps to lower your costs:

- Shop around: Compare quotes from multiple insurers to ensure you’re getting the best rate.

- Improve your home’s security: Install security systems and take other steps to reduce the risk of theft or damage.

- Maintain your home: Regular maintenance can prevent costly repairs and lower your insurance risk.

- Increase your deductible: A higher deductible will typically lower your premium, but consider your financial ability to pay a larger out-of-pocket expense.

- Bundle your insurance: Combine your home and auto insurance policies to potentially receive a discount.

- Ask about discounts: Inquire about any available discounts, such as those for loyalty, payment methods, or home safety features.

Frequently Asked Questions (FAQ)

What is Amica Mutual Insurance’s reputation?

Amica Mutual Insurance is known for its strong financial stability, excellent customer service, and high customer satisfaction ratings. They consistently receive positive reviews for their claims handling process.

How do I file a claim with Amica?

You can file a claim with Amica through their website, by phone, or by contacting your local Amica agent. They provide detailed instructions on their website for various claim types.

Does Amica offer flood insurance?, Amica home insurance cost

Amica typically does not offer flood insurance directly. Flood insurance is usually purchased separately through the National Flood Insurance Program (NFIP) or a private insurer.

Can I pay my Amica home insurance premium monthly?

Yes, Amica typically allows for monthly payment options, although paying annually might offer a discount.

What types of home insurance does Amica offer?

Amica offers a range of home insurance options, including standard homeowners insurance, and specialized coverages tailored to different needs. It’s best to contact them directly or check their website for the most up-to-date information on available policies.

Resources: Amica Home Insurance Cost

For more information on Amica home insurance and to get a personalized quote, visit the official Amica Mutual Insurance website: [Insert Amica’s Website Here]

For information on the National Flood Insurance Program: [Insert NFIP Website Here]

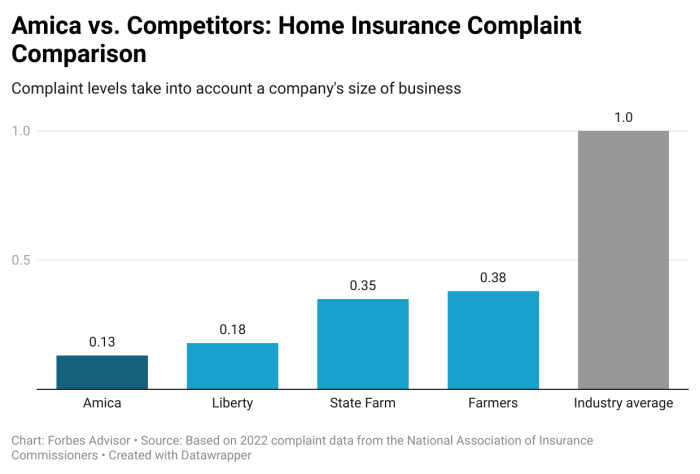

Source: forbes.com

Call to Action

Ready to protect your home with Amica’s reliable coverage? Get a free quote today! Contact an Amica agent or visit their website to learn more and find the best policy to fit your needs and budget.

Query Resolution

What factors besides location and home features affect Amica home insurance cost?

Your credit score, claims history, and the type of coverage you choose (e.g., liability limits, deductible) significantly influence the premium.

Does Amica offer discounts?

Yes, Amica often provides discounts for various factors such as bundling insurance policies, having security systems, or being a long-term customer. Contact them directly to inquire about available discounts.

Source: taxuni.com

How can I get a quote from Amica?

You can obtain a quote online through their website or by contacting an Amica agent directly. Be prepared to provide detailed information about your home and coverage preferences.

What happens if I need to file a claim?

Amica has a claims process Artikeld on their website. Contact them immediately after an incident to report the claim and follow their instructions. They will guide you through the necessary steps.